Economic Outlook and Growth

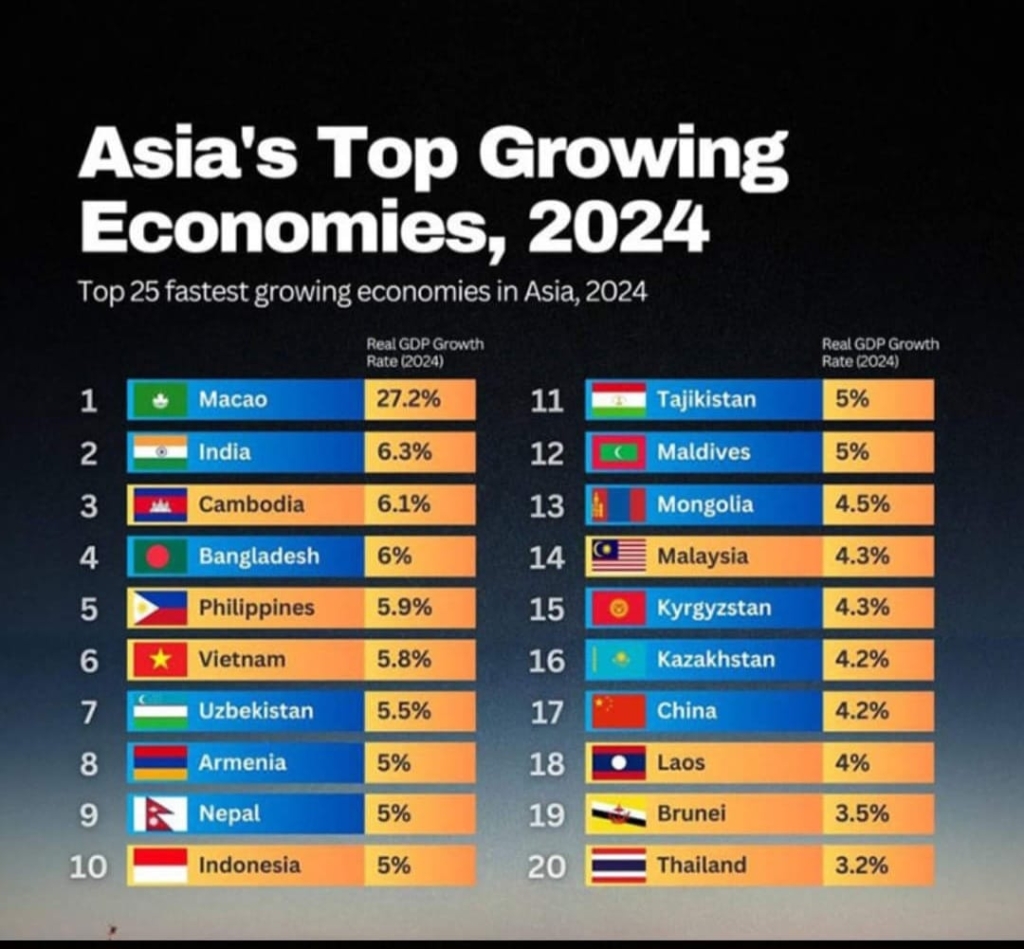

The property market in Cambodia is set to experience notable developments in 2024, buoyed by a robust economic outlook for the broader ASEAN+3 region. The Macroeconomic Research Office (AMRO) projects a regional growth rate of 4.5%, with Cambodia poised to outpace this at 6.2%. Further optimism comes from the National Bank of Cambodia (NBC), forecasting a growth rate of 6.4%, reflecting strong economic fundamentals and a positive investment climate.

Hospitality and Tourism Sector

Cambodia’s hospitality and tourism sector is on the cusp of significant expansion. Banyan Tree Holdings Limited will launch the ‘Angsana Siem Reap’ in Q3 2024, offering 158 rooms, suites, and villas. Additionally, Novotel’s first Cambodian property, the Novotel Sihanoukville Holiday Resort, opened in Q1 2023, marking the entry of high-profile brands into the market. The rise in international tourist arrivals and the reinstatement of major airline services like AirAsia and Emirates highlight the sector’s recovery and potential growth. The Angkor Wat ticket sales rebound further reinforces a positive outlook for tourism, which is crucial for the hospitality sector.

Office Real Estate Market

Phnom Penh’s office real estate market is witnessing cautious growth. The current occupancy rate stands at 62.2%, reflecting an imbalance between supply and demand. However, projections indicate significant growth, with over 171,000 square meters of new office space expected in 2024 and 268,000 square meters in 2025. This growth is driven by anticipated economic expansion, foreign investments, and local business developments post-pandemic. Rental prices have remained relatively stable, with Grade A spaces in the CBD (Central Business Districts) seeing a slight decrease of 2.8%, while Grade B spaces in non-CBD areas have seen slight increases, indicating a shift toward more affordable options.

Retail Sector

7-Eleven, Big C and other Retail giants have already started operations and opened more than a hundred branches in Phnom Penh, Sihanoukville, Siem Reap and Battambang.

Phnom Penh’s retail sector is in a period of transformation. Despite a decline in retail occupancy rates to 63.4%, the city plans to add over 101,000 square meters of retail space in 2024 and an additional 116,000 square meters in 2025. This expansion includes shopping malls, community malls, and retail podiums, signaling an optimistic outlook driven by expected increases in consumer spending and economic recovery. Phnom Penh’s retail space per capita remains lower than more developed ASEAN counterparts, highlighting significant growth potential. Competitive retail rents further enhance the market’s appeal to new retailers and international brands.

Residential Market

The residential market in Phnom Penh shows signs of stabilization after a large market correction in 2023. The diverse business landscape, with a significant portion of SMEs operating in spaces smaller than 200 square meters, and the stable rental market, offer predictability for operational costs, essential for strategic planning and fostering competitiveness. This stability is crucial for the ongoing evolution of workplace dynamics and the broader economic resilience.

Construction and Development

Cambodia’s construction sector thrived in 2023, with 3,207 projects worth US$5.4 billion approved. This trend is expected to continue, with significant investment projects planned for coastal provinces like Preah Sihanoukville. The surge in construction material imports, nearly US$350 million in Q1 2024, underscores the booming construction sector, reflecting strong development activities.

Koh Rong airport construction is going on as scheduled. AirAsia started internal flights in Cambodia. This will bring high number of tourists especially from Siem Reap to Koh Rong.

The Sihanoukville Phnom Penh express highway enables 2h trips to Sihanoukville from Phnom Penh.

Trade and Investment

Cambodia’s trade with ASEAN countries rose by 18.64% to $4.32 billion in Q1 2024 (see this report), driven by increased economic agreements and a positive business sentiment fostered by the Cambodian Prime Minister’s international engagements. The country’s garment, footwear, and travel goods exports also saw a 20% increase, highlighting the growing industrial sector.

More than a Recovery

Cambodia’s property market in 2024 is characterized by cautious optimism and strategic growth across various sectors. The anticipated economic growth, substantial foreign investments, and strategic developments in hospitality, office, retail, and construction sectors indicate a positive trajectory. As the country continues to recover from the pandemic and attract international attention, the property market is set to benefit from these broader economic trends, positioning Cambodia as a dynamic and promising market in the ASEAN region.

Here are the selected property listings (all hard title) in Koh Rong and Koh Rong Samloem, Cambodia:

- Land

- $70,000

- $17/sqm

Cheapest Land on Koh Rong at Lonely Beach

Lonely Beach, ក្រុងកោះរ៉ុង, ខេត្តព្រះសីហនុ, ព្រះរាជាណាចក្រកម្ពុជា4120 m²

Title Deed: Hard Title

Contact me

- Resort

- $6,500/month

Seaview Bungalow Resort for Rent in the Heart of Koh Rong

Koh Touch, Koh Rong, Preah Sihanouk, CambodiaBeds: 11

1250 m²

Title Deed: Hard Title

Contact me

- Land, Villa/House

- $130,000

Seaview House with Land for Sale at Sok San Beach, Koh Rong

Sok San Beach, Koh Rong, CambodiaBeds: 2

250 m²

250 m²

Title Deed: Hard Title

Contact me

- Land

- $578,000

- $85/sqm

Premium Seaside Land Near Sok San Beach, Koh Rong Island

Sok San Beach, , Koh Rong, Cambodia6800 m²

Title Deed: Hard Title

Contact me

- Land

- $65,000

Prime Development Opportunity: 300m to the beach

Koh Rong, Preah Sihanouk, Cambodia600 m²

Title Deed: Hard Title

Contact me

- Land

- $120,000

Prime Seaview Land for Sale: Your Slice of Paradise on Koh Rong’s Longset Beach

Longset Beach, Koh Rong, Cambodia500 m²

Title Deed: Hard Title

Contact me

- Land

- $550,000

Prime Commercial Beachfront: Exceptional Land for Sale on Koh Touch Beach

Koh Touch, Koh Rong, Cambodia1010 m²

Title Deed: Hard Title

Contact me

- $700,000

Exclusive Beachfront Paradise: Prime Land for Sale on Koh Rong’s Coconut Beach

Coconut Beach, Koh Rong, Cambodia1007 m²

Title Deed: Hard Title

Contact me

- Land, Resort

- $1,500/month

Seaview Resort – Prime Property for Rent

Koh Rong Main Beach, Koh Rong, CambodiaBeds: 10

3000 m²

3000 m²

Join The Discussion